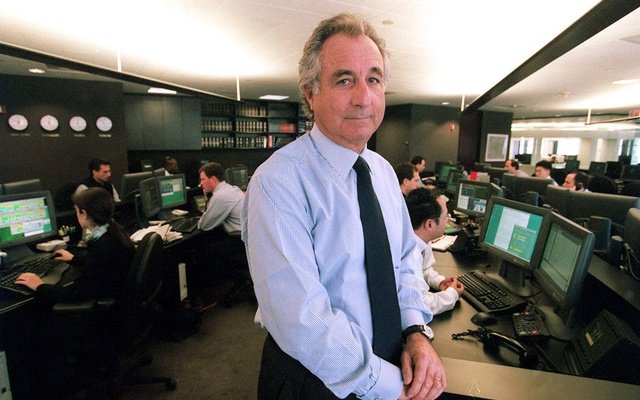

On the tenth day of December, the year 2008, Bernard Madoff walked into his family gathered together, and blatantly delivered the most devastating news.

“Its all one big lie!”

The weight of that statement was shattering. How could that be said of the most outstanding investment fund of the time?

Its record was highly impressive and almost impeccable; not even the snoopy Securities and Exchange Commission (SEC) had caught wind of it. But all things considered, he was extremely lucky to have run his scheme for such a long time without being caught.

The scam Madoff turned into a bed of fortunes 38 years ago had now reached its ultimate moment of vanquishment, courtesy of the 2008 financial crisis. In the light of this crisis, everyone wanted to withdraw their money out of fear of losing it all.

This left Madoff brutally exposed, with no possible way of refunding his clients.

Madoff’s scheme operated in this manner: money from new investors would be used to pay off older investors – of course with an interest. There was no investment done on the money people entrusted to his fund. All of it sat around in the banks waiting to be circulated as dividends to unsuspecting clients.

Paying out dividends with no profit making investment was no fuss for Madoff, because new investors kept flocking into his reputable fund day after day. He had a very big pool of money amounting to $65 billion from clients.

This is today’s equivalent of 6.9 Trillion Kenya Shillings. That’s enough to fully fund Kenya’s national budget for 4 years.

Normally, when people deposit their savings into an investment fund, their money is used to run profitable investments. Profit generated from these investments is then shared among shareholders as dividends. That’s how an ideal investment fund should operate.

Doctored to look legit

Madoff doctored stock reports to make his fund look legit. According to his reports, the investment fund never made loss. Even when others dipped into losses, it rocked straight profits every year. This built Madoff such a reputation in financial circles. He was an investment hotcake.

Everyone wanted to entrust him with their life savings. After all, who wouldn’t have wanted to invest in a company that never made losses?

Rules of engagement

An opportunity to invest in Madoff’s fund came with stringent rules. No telling was the ultimate rule. No one was allowed to discuss about the fund and its owner openly. It was to remain between investor and investee.

No snooping around was another well established rule. You weren’t allowed to ask questions on how the dummy profits were made. In case you appeared too stubborn for answers, the fund was more than ready to wire back all your money.

So no one seemed to have interest in finding the truth about the scheme because the rules of engagement held them tight against the wall. This should have served as a forewarning about the dubious schemes.

People have always been lured by the prospect of making quick, effortless cash. They move into the arms of cunning fraudsters, blinded by misguided optimism or greed.

The devil lies in the detail

Even the red flags – both small and striking ones – become negligible. However with a careful attention to detail, even a Madoff scheme can be evaded.

There is no worse feeling than the sudden realization that you’ve just been Ponzi-ed; robbed of all you have.

It is always best to be apprehensive of anything that looks very promising.